Gross Salary Meaning Mom

If you work more than one job youll have a gross salary amount for each one. For calculation of Income Tax gross salary minus the eligible deductions are considered.

The Cyber Security Hub Overview Linkedin Carnet De Veille En 2019 Securite

If you work more than one job youll have a gross salary amount for each one.

Gross salary meaning mom. Meaning What is meant by a word. Gross Salary is the amount employee earns in the whole year span of time without any deduction. Taxation Process of Gross Salary.

Gross salary is the term used to describe all of the money youve made while working at your job figured before any deductions are taken for state and federal taxes Social Security and health insurance. Gross salary can be defined as the amount of money paid to an employee before taxes and deductions are discounted. Overtime payments bonus payments and annual wage supplements AWS.

For instance you will have to deduct HRA exemption any home loan EMI investments under section 80C and 80D and similar such things for. For example when an employer pays an employee a monthly salary of RM4000 this means the employee has earned RM4000 in gross salary. Taxation Process of Gross Salary.

For self-employed persons gross monthly income. It may include salary annual rate wages hourly rate bonuses or reimbursements if any vacation pay holiday pay or commissions. Gross pay is the employees income before any pension or salary sacrifice deduction.

Gross salary is the amount your employer pays you ie John gets paid 50hour as an electrical engineer. Net salary is less than the Gross salary amount after deducting all taxes. Creditors often look at your gross salary when determining whether or not they should extend you credit and if they.

The sum of all those individual components on a yearly or monthly basis is the gross salary. Gross salary is the amount your employer pays you ie John gets paid 50hour as an electrical engineer. His annual gross salary is 50hour x 2000 hoursyear 100000year.

The gross salary which is determined by the monthly or annual salary indicated in the employment contract or the binding job offer may not be lower than the minimum salary determined by the Member States for this purpose which is at least equivalent to one and a half times 15 of the average gross annual salary in the relevant Member State. Gross salary is the term used to describe all of the money youve made while working at your job figured before any deductions are taken for state and federal taxes Social Security and health. The gross salary is mentioned in the companys offer letter in the salary section which mainly enlist all the components of the pay package.

The amount computed by adding the basic salary and allowances but without the taxes and other deductions such as EPF and Socso. Gross salary is the term used to describe all of the money youve made while working at your job figured before any deductions are taken for state and federal taxes Social Security and health insurance. Types of salary deductions allowed in accordance with the Employment Act.

Gross rate of pay includes allowances that an employee is entitled to under a contract of service What is excluded Gross rate of pay excludes. Gross monthly income from work refers to income earned from employment. The total amount your employer pays you.

Gross includes bonuses overtime pay holiday pay etc. It comprises basic wages overtime pay commissions tips other allowances and one-twelfth of annual bonuses. Net Salary is the salaried employees net amount after deduction Income Tax PPF Professional Tax.

Gross Monthly Income From Work refers to income earned from employment. Gross pay is the total amount of money an employee receives before taxes and deductions are taken out. Gross Salary Meaning.

For employees it refers to the gross monthly wages or salaries before deduction of employee CPF contributions and personal income tax. For example when an employer pays you an annual salary of 50000 per year this means you have earned 50000 in gross pay. Gross salary is basically the salary which is without any deductions like income tax PF medial insurance etc.

Therefore Net Salary Gross Salary Deductions Rs70000 Rs14000 Rs56000. Registered Nurse Salary In Canada. Earnings of a person prior to the deduction of income tax.

His annual gross salary is 50hour x 2000 hoursyear 100000year. For example you will have to deduct HRA exemption any home loan EMI investments under section 80C and 80D and similar such things for calculation of taxable income. It is different from Taxable pay.

Earnings of a person prior to the deduction of income tax. The total amount your employer pays you. For employees it refers to the gross monthly wages or salaries before deduction of employee CPF contributions and personal income tax.

Basic salary is the amount agreed upon by an employer and employee excluding overtime or any other extra compensation. It is the gross monthly or annual sum earned by the employee. Reimbursement of special expenses incurred in the course of employment.

Gross salary is the maximum amount of the salary inclusive of all taxes. So Net Salary Gross Salary Deductions Rs83000 Rs13000 Rs70000. The gross salary denotes the maximum compensation that the employer pays to each of its employees.

Gross Salary is the sum total of all the components of your remunerationsalary package. It is the gross monthly or annual sum earned by the employee. It comprises basic wages overtime pay commissions tips other allowances and one-twelfth of annual bonuses.

To calculate Income Tax gross salary minus the eligible deductions are considered. Monthly and daily salary Definitions and calculation for incomplete month of work gross rate of pay and basic rate of pay. Creditors often look at your gross salary when determining whether or not they should extend you credit and if they.

Gross salary can be expressed as an annual salary or as a gross monthly income. The monthly gross salary means the maximum monthly income that your employer pays while the annual amount is the aggregation of the monthly gross pay.

Is The Variable Pay Part Of A Gross Salary Quora

Gross Vs Net Income Financial Infographic From Accc Learn More About Personal Finances To Better Mana Net Income Debt Relief Programs Credit Card Debt Relief

Pr Application Basic Salary And Gross Salary Singapore Expats Forum

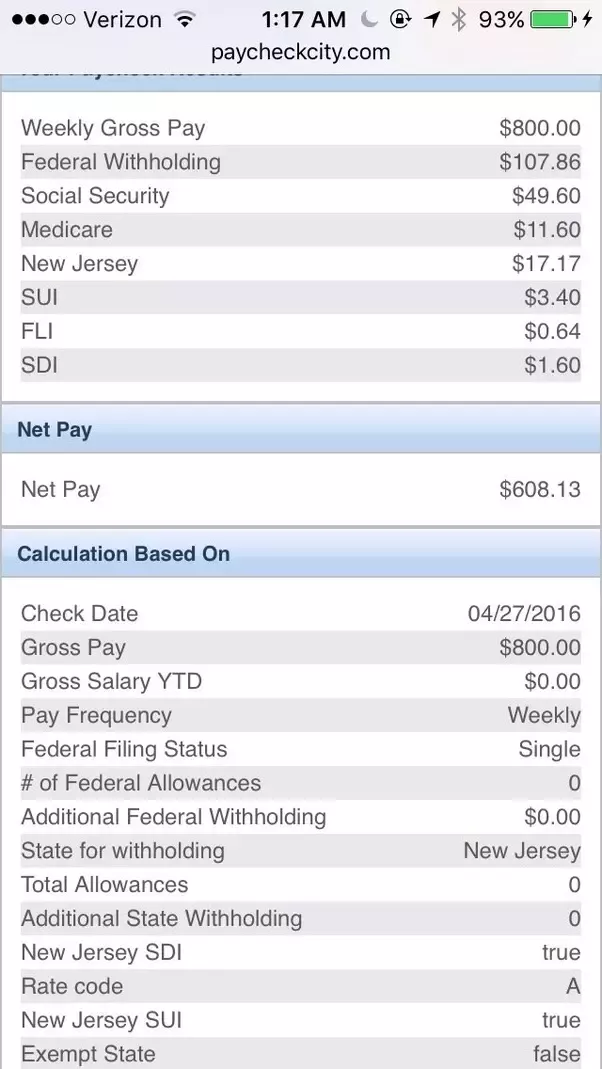

I Make 800 A Week How Much Will That Be After Taxes Quora

Sales Cost Of Goods Sold And Gross Profit Cost Of Goods Sold Cost Of Goods Cost Accounting

Gross Me Out Margins Mark Ups Other Nasties Beanstalk Knowhow

What Is The Difference Between Basic Salary And Base Salary Quora

A Little Boy And Mother S Love In 2021 Funny Mom Jokes My Children Quotes Mom Jokes

How Much Money Do You Actually Take Home If You Earn The Median Salary In Singapore

What Does Monthly Deduction For Others Actually Mean Twc2

Small Business Daily Payroll Tracker Ledgers For Hourly And Etsy Payroll Small Business Business

What Will Be My In Hand Salary If Ctc Is 2 50 Lakhs Quora

Gross Vs Net Income Importance Differences And More Bookkeeping Business Accounting And Finance Finance Investing

Is 70k Gross A Good Salary For A Family Of 3 To Relocate In Eindhoven Netherlands Quora

How To Understand The Salary Structure Quora

What Does Monthly Deduction For Others Actually Mean Twc2

Post a Comment for "Gross Salary Meaning Mom"