Gross Salary Include Allowance

To put it in simpler terms Gross Salary is the amount paid before deduction of taxes or other deductions and is inclusive of bonuses over-time pay holiday pay and other differentials. Write a program to calculate his gross salary include void main int sr.

Gross Salary Definition Importance Example Human Resources Hr Dictionary Mba Skool Study Learn Share

Variable pay Cash rewards linked to performance Other allowances Salary arrears Meal coupons in the form of card or voucher Overtime payments.

Gross salary include allowance. For example when an employer pays an employee a monthly salary of RM4000 this means the employee has earned RM4000 in gross salary. Employee contribution to the Provident Fund PF. Gross salary includes basic salary housing allowances and transportation allowances.

Gross rate of pay includes allowances that an employee is entitled to under a contract of service What is excluded Gross rate of pay excludes. House rent allowance or HRA. 40000 and a basic salary is Rs18000 he or she will get Rs18000 as fixed salary in addition to other allowances such as House rent allowance conveyance communication dearness allowance city allowance or any other special allowance.

Gross salary is the amount of salary after totalling all the benefits and allowances but before deducting any tax while net salary is the amount that an employee takes home. Allowance is a fixed monetary amount paid by the employer to the employee for meeting some particular expenses whether personal or for the performance of his duties. It is a salary component that covers the housing expenses of employees.

Gross Salary Basic HRA DA Allow PF. Both an employer and an employee contribute. Overtime payments bonus payments and annual wage supplements AWS.

Every form of wage including basic salary allowances bonuses etc comes under gross salary actually it is a general term for total wagesalary. For self-employed persons gross monthly income refers to the average monthly profits from their. His dearness allowance is 40 of basic salary and house rent allowance is 20 of basic salary.

Given an integer basic and a character grade which denotes the basic salary and grade of a person respectively the task is to find the gross salary of the person. Pension fund administrators may charge up to 100 naira a month and up to 2 of assets a year for administrative fees. Gross includes bonuses overtime pay holiday pay etc.

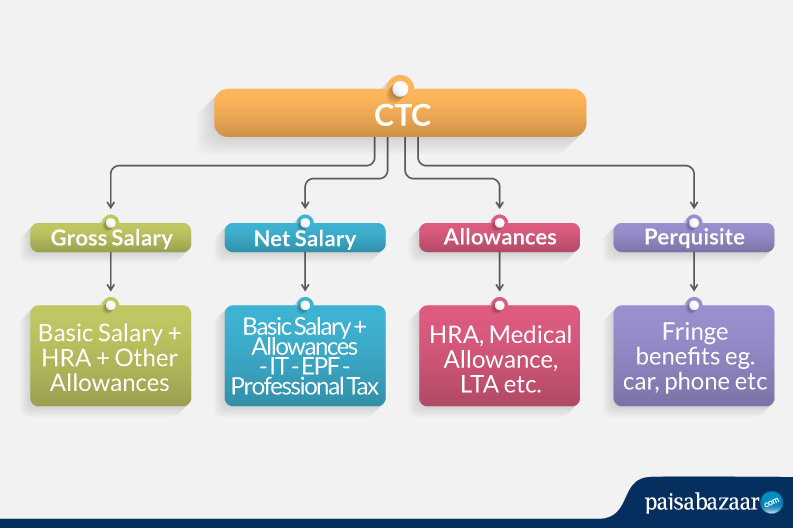

All the salary components are calculated on Basic Salary apart from ESI. Gross Salary is employee provident fund EPF and gratuity subtracted from the Cost to Company CTC. The final salary computed after the additions of DA HRA and other allowances.

175 of Gross Salary. It is not inclusive of bonuses incentives benefits or any such perks from an employer. Additional voluntary contributions are possibleThere are no maximum earnings used to calculate contributions.

Gross income is all amounts received or earned not of a capital nature so would include allowances but not the sale of a home. Employees whose Gross Salary is Rs10000 or less than Rs10000 PM is entitled for having ESI as a part of salary structure. These are generally the allowances which are incurred by the company and added to the basic salary of an employee.

Net salary is also referred to as. These allowances are generally taxable and are to be included in the gross salary unless a specific exemption has been provided in respect of any such allowance. The following are a few other components that form part of the gross salary.

Net Salary Gross salary - All deductions like income tax pension professional tax etc. It constitutes a number of elements like House Rent Allowance Provident Fund Dearness Allowance Medical Insurance etc. 475 Employee Contribution.

For instance if an employee has a gross salary of Rs. It comprises basic wages overtime pay commissions tips other allowances and one-twelfth of annual bonuses. The components of a gross salary include several benefits some of which are elaborated below.

For employees it refers to the gross monthly wages or salaries before deduction of employee CPF contributions and personal income tax. The formula for Gross Salary is defined as below. Reimbursement of special expenses incurred in the course of employment.

Allowance is a fixed monetary amount paid by the employer to the employee for meeting some particular expenses whether personal or for the performance of his duties. An individuals gross salary is inclusive of benefits such as HRA conveyance allowance medical allowance etc. The amount computed by adding the basic salary and allowances but without the taxes and other deductions such as EPF and Socso.

Also you can include Medical Reimbursement Component in the salary structure which is. These allowances are generally taxable and are to be included in the gross salary unless a specific exemption has been provided in respect of any such allowance. Only ESI is calculated on Gross Salary Employer Contribution.

Specific exemptions in respect of allowances are provided under the. Gross Salary is the amount of salary after adding all benefits and allowances but before deducting any tax Net Salary is the amount that an employee takes home An individuals gross salary includes benefits like HRA Conveyance Allowance Medical Allowance etc.

What Does Gross Salary Mean Quora

Salary Slips In 2021 How Do They Work Samples Tax Deductions Components Scripbox

Salary Slip Components Importance Yadnya Investment Academy

Gross Salary Simplified Definition Components Calculation Razorpayx Payroll

Payslip In France How Does It Work Blog Parakar

Salary Net Salary Gross Salary Cost To Company What Is The Difference

Salary Net Salary Gross Salary Cost To Company What Is The Difference

What Is Gross Salary How To Calculate Gross Salary

What Are Deductions From Salary Under Section 16 Deductions From Sal

Gross Salary Definition Importance Example Human Resources Hr Dictionary Mba Skool Study Learn Share

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Gross Salary Vs Net Salary Top 6 Differences With Infographics

Salary Slip Components Importance Yadnya Investment Academy

What Is Basic Salary Gross Salary And Net Salary Monetarysection Com

Payslip In France How Does It Work Blog Parakar

Salary Structure Components How To Calculate Take Home Salary

Terms Used When Calculating Payroll Payrollhero Support

What Is Basic Salary Definition Formula Income Tax Exceldatapro

Post a Comment for "Gross Salary Include Allowance"